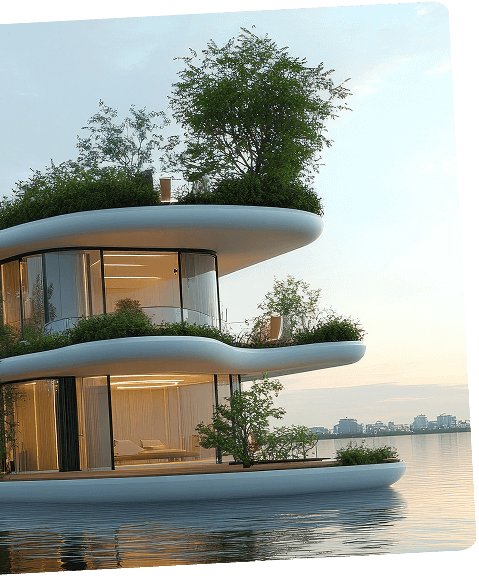

Finance Your  Home with Confidence

Home with Confidence

Helping Canadians buy, invest, and build wealth across the border. Let’s make your U.S. real estate goals a reality.

Who We Are

Lets connect! Schedule a consultation today and lets make your real estate dreams a reality

With over a decade of experience helping Canadians enter the U.S. real estate market, we specialize in cross-border financing solutions for primary residences, vacation homes, rental properties, and investment opportunities. Our personalized approach, deep market knowledge, and commitment to client success ensure you’re supported at every step. Whether you’re purchasing your first U.S. property, expanding your portfolio, or refinancing, we’ll help you navigate the process with ease.

Why Choose Us

- We understand the unique challenges Canadians face when financing U.S. properties.

- Whether vacation, rental, or investment, we customize the right financing strategy.

- A seamless process backed by industry certifications and proven experience.

We provide many services to help clients buy, sell, rent, and invest in properties.

Whether you're buying, selling, renting, or investing, we provide expert guidance and a seamless experience at every step.

U.S. Vacation Home Mortgages

Buy your winter retreat with financing options made for Canadians.

- Tailored financing solutions for Canadians

- Guidance through U.S. mortgage requirements

- End-to-end support from pre-approval to closing

Refinancing Options

Tap into better rates or unlock equity for upgrades or new purchases.

- Save on payments with lower rates

- Unlock cash for upgrades or new buys

- Simplify your mortgage to fit your lifestyle

Investment Property Guidance

Interested in renting your U.S. home when you’re back in Canada?

- Market research & U.S. property analysis

- ROI calculations & risk assessments

- Access to exclusive cross-border opportunities

Ready to Get Started? Contact us today for a free consultation!

"Highly Professional & Trustworthy!"

Snowbird Mortgages made the whole process of buying our Florida condo seamless. As Canadians, we were nervous about financing in the U.S., but they explained everything clearly and handled all the details.

Jason Follansbee

Homeowners

"Highly Professional & Trustworthy!"

We refinanced our Arizona winter home through Snowbird Mortgages and freed up cash for renovations. Quick, professional, and always available to answer our questions—highly recommend

Jhene Folio

Agent

"Highly Professional & Trustworthy!"

This was our first U.S. property, and we didn’t know where to start. The team walked us through step by step and found us a great rate. Now we enjoy our winters in Palm Springs stress-free.

Alex Maiko

Homeowners

Have questions or need expert real estate advice? Fill out the form below, and we'll get back to you ASAP!

Get in touch with us.

Frequently Asked Questions

Have questions about buying, selling, or investing in real estate? We've got the answers!

Contact Us Today! We're happy to help you with all your real estate needs.

The process typically takes 30-45 days after an offer is accepted, depending on financing, inspections, and negotiations.

For U.S. property purchases, Canadians typically need a down payment of 20% to 30% of the purchase price, depending on the property type, loan amount, and lender requirements. Luxury or investment properties may require higher down payments.

Most lenders require a minimum credit score of 680 for Canadians purchasing U.S. property, though higher scores (700+) can qualify you for better rates and terms.

You can determine the right price by comparing recent sales of similar properties in the area, factoring in location, condition, and market trends. Working with a trusted advisor like Snowbird Mortgages can help ensure your offer aligns with fair market value and financing requirements.

Selling a home typically involves real estate agent commissions (5–6%), legal fees, closing costs, and potential repairs or staging expenses. You may also need to account for capital gains taxes if the property has appreciated in value.

Yes — real estate can be a good investment, offering consistent returns, asset appreciation, and portfolio diversification. It’s especially attractive when paired with rental income or long-term growth potential in high-demand markets.

The first step is to speak with a mortgage advisor or realtor to understand your financial position, market conditions, and available options. This helps you set a clear strategy before beginning the buying or selling process.